It’s no big secret that most employees don’t understand their salary. The salary calculation is visible on the payslip, but people usually do not understand what it means or how the payroll is calculated. They only look at one item, the last one on the list – the amount they will receive in their checking account.

It is good to understand the payslip since it shows the salary calculation. Every employee should know what makes up his salary to be able to monitor whether his employer pays all required taxes and mandatory contributions, which unfortunately is not always the case. Also, it may happen that the employee does not receive all the benefits or material rights to which he is entitled.

Don’t just read about payslips and payroll, look for a better salary! Our AI system will recommend you the best vacancies for you!

What is salary?

Salary is the monetary income that the employer pays to the employee for his work based on a concluded employment contract at regular intervals (usually every month). An employment contract can be a fixed-term employment contract or an indefinite-term employment contract, and it can also differ according to whether the worker is employed full-time or part-time.

The employee must understand that his salary is prescribed by the signed employment contract, so this is one of the things he must pay close attention to when signing the employment contract.

What are a payslip and a payroll?

A payslip is the basic document that accompanies the payment of each salary and is a written calculation of salary. It is an essential part of the payroll process. For the employer, it represents a payment invoice for an individual employee.

How to get the payslip?

Employees usually wonder where to view their payslip/payroll.

For civil servants in Croatia, the payslip is online, that is, the payslip is obtained through the e-Građani system, which delivers the payroll to citizens to their Personal User Box. However, if for some reason the employee does not have a personal user box, they can request a written printout and delivery of the payslip.

In the private sector, payslips can be delivered electronically (usually via a code-protected document), delivered in person (often in a sealed envelope), or by post (registered delivery with return receipt).

Many workers are interested in whether the payslip must be certified. In the past, they had to be signed and certified with an official stamp, but nowadays they are not because they are often electronic. However, it is important to note that at the request of the employee, the employer must certify the payroll. This is important because in the event of a dispute, the payslip is the basis for the forced collection of claims.

As a rule, the employer should ask the employee to confirm that they have received the payslip by replying to the message, signing a receipt, or in a similar way.

Until when must the payslip be issued?

The employer usually issues the salary calculation or payslip together with the payment of the salary. If the employer has not delivered the pay slip, the employee has the right to request it. The employer is obliged to hand over the payroll information to the employee no later than 15 days after the payment of the salary. Pay slips are official documents and not issuing them with the salary is a serious offense.

Even if the employer did not pay all or part of the salary, the employer has to deliver the payslip with the calculation of the salary that they were obliged to pay to the employee by the end of the month in which the payment of the salary, salary compensation or severance pay was due.

Additionally, the employer is obliged to keep all accounting documents (which includes form IP1, i.e. payslip for paid salary, form NP1 for unpaid or partially unpaid salary, form NO1 for compensation for unused annual leave, form IO1 for severance pay or compensation for unused annual leave ) for at least six years. If a labor dispute has been initiated for which the accounting documents are relevant, the employer must keep them until the end of the legal settlement of the dispute.

What do the payslip and payroll look like?

As mentioned, the payslip is the invoice of the employer’s total expenses for the payroll so it breaks down the employer’s gross expenses in detail. The payslip is an explanation of the costs that the employer has towards the employee and the state.

The payroll form for the payslip differs from employer to employer, but must always contain the same components. That is why the form represented by the payslip follows established rules and it is possible to simply explain it.

The payslip must include basic information about the legal entity or the employer: company name, registered office, personal identification number (OIB), and the IBAN bank account number. For a natural person or employee, it must contain information about the worker’s name and surname, address, personal identification number (OIB), and IBAN bank account number.

In addition, the payslip contains information about the employee’s length of service, the month for which the salary is paid, and the calculation units. Calculation units are hours worked that are broken down by items of regular work, holidays, vacation, or sick leave.

1. Gross amount

At the beginning of the payslip is the gross amount (accounting calls it gross1 or “bruto1“). This gross amount is the amount on which the social security contributions, that is mandatory contributions for pension insurance and taxes are calculated (and before 2024, a surtax of 10 to 18 percent was also calculated on it, depending on the municipality or city).

Most workers usually do not pay attention to this, but the gross1 salary is the actual amount that the employee agrees with the employer as the monthly salary amount.

2. Income

After contributions from the salary or pension insurance contributions are deducted from the gross salary, we arrive at the part of the salary called income.

Pension insurance contributions amount to 15% of the gross salary for the first pillar payment of pension insurance and 5% of the gross salary for the second pillar payment of pension insurance. It is worth noting that older employees in Croatia are only participating in the first pillar of pension insurance, so they pay the entire 20% into it.

According to the wage reform, starting in 2024, the basis for calculating contributions to the first pillar of pension insurance for workers whose gross monthly salary is less than 1,300 euros will be reduced. There are two classes. For workers who receive a gross salary of up to 700 euros, the basis for calculation is reduced by flat 300 euros. For workers who receive a gross salary between 700 and 1,300 euros, the monthly basis for calculating pension insurance contributions is reduced by the amount of half the difference between the gross salary and the limit of 1,300 euros (formula: 0.5 x (1,300 – amount of gross salary)).

3. Tax-free personal allowance

A personal allowance or non-taxable base is deducted from the income. According to the Croatian Income Tax Act, there are four categories of personal allowances: basic personal allowance, allowance for dependent children, allowance for dependent family members, and disability allowance.

The basic personal allowance for a single person from 2024 is 560 euros, for the first dependent child 280 euros, for disability 168 euros respectively 560 euros for total disability.

Dependent family members are natural persons whose sources of income do not exceed six times the amount of the basic personal allowance, which from 2024 amounts to 3,360 euros per year.

4. Tax base

After that, the tax base is calculated. Until 2024, income tax was paid at a rate of 20% on amounts up to EUR 3,981.69, and 30% on amounts above that. The tax reform from the second half of 2023 abolished the surtax (tax on tax) from 2024.

For this reason, cities and municipalities (units of local self-government) are allowed to prescribe the level of the income tax rate for annual taxes (within the limits prescribed by law). Annual income tax rates per local self-government unit can be found on the website of the Tax Administration of the Republic of Croatia.

The limits prescribed by law are:

- for municipalities (previous surcharge up to 10%), the lower rate can be from 15 to 22%, and the higher rate from 25 to 33%

- for cities with up to 30,000 inhabitants (previous surcharge up to 12%), the lower rate can be from 15 to 22.4%, and the higher rate from 25 to 33.6%

- for cities with more than 30,000 inhabitants (previous surcharge up to 15%), the lower rate can be from 24 to 34.5%

- for the City of Zagreb (previous surcharge 18%), the lower rate can range from 15 to 23.6%, and the higher from 25 to 35.4%

5. Net salary

After calculating the gross1 amount, income, and taxes, the net salary is calculated. However, the net salary is not the final amount that the employee receives.

6. Non-taxable income

Namely, allowances, i.e. material rights and other non-taxable incomes are added to the net salary. They consist of:

- per diems or daily allowance for business trips, marine allowance, travel expenses, transportation, and allowances for the use of a private car

- food and accommodation costs

- expenses for the purchase of water, hot and cold drinks, which the employer provides at his own expense to the workers during working hours

- prizes (Christmas gifts, gifts for children, etc.)

- monetary rewards for work results

- jubilee awards for a certain number of completed years of service

- tips (they start to be fiscalized from 2024)

- reimbursement of vacation expenses – Croatian tourist card (Cro card)

- gifts to a child (up to 15 years of age, i.e. who turned 15 by December 31 of the current year)

- gifts in kind (goods)

- newborn aid

- allowances for the costs of regular care of children of workers

- allowances for living apart from family

- education costs related to the employer’s activities

- grants due to damage or destruction of property due to a natural disaster

- physical exam for the work requirements

- testing for infectious disease agents and vaccination against infectious diseases (COVID)

- voluntary pension insurance premiums

- supplementary and additional health insurance premiums

- cash donations for health needs, the treatment of which is not covered by some form of health insurance or by the employee’s funds

- severance pay (due to retirement, business-related or personally-related layoffs, professional illness or work-related injuries)

- support due to the worker’s disability

- support in case of the death of the worker

- one-time support in case of death of a member of the worker’s immediate family

- child support for education up to the age of 15 (i.e. completion of primary school education) paid by the employer to the child of a worker who has completely lost his ability to work or has died

- support due to continuous sick leave of the worker lasting more than 90 days

- reimbursement of costs or compensation for working from home

To put it simply, tax-free receipts mainly consist of reimbursements for transportation, lodging, meals (usually a hot meal), working from home, or insurance.

7. Total salary cost

A health insurance contribution is paid on the gross1 salary amount, which is the basis for salary calculation. The combination of the gross1 salary amount and the health insurance contribution gives the gross2 or “bruto2” salary.

It may be confusing that payslips list contributions from the salary and contributions to the salary. Namely, allocations for pension insurance are the employee’s obligation, so they are allocated from the employee’s gross salary, and allocations for health insurance are the employer’s obligation, so they are the employer’s contributions to the gross salary.

Gross2 salary represents the employer’s total cost for each employee. Put simply, it is the amount that the employer must earn to be able to pay the employee’s salary to the current account.

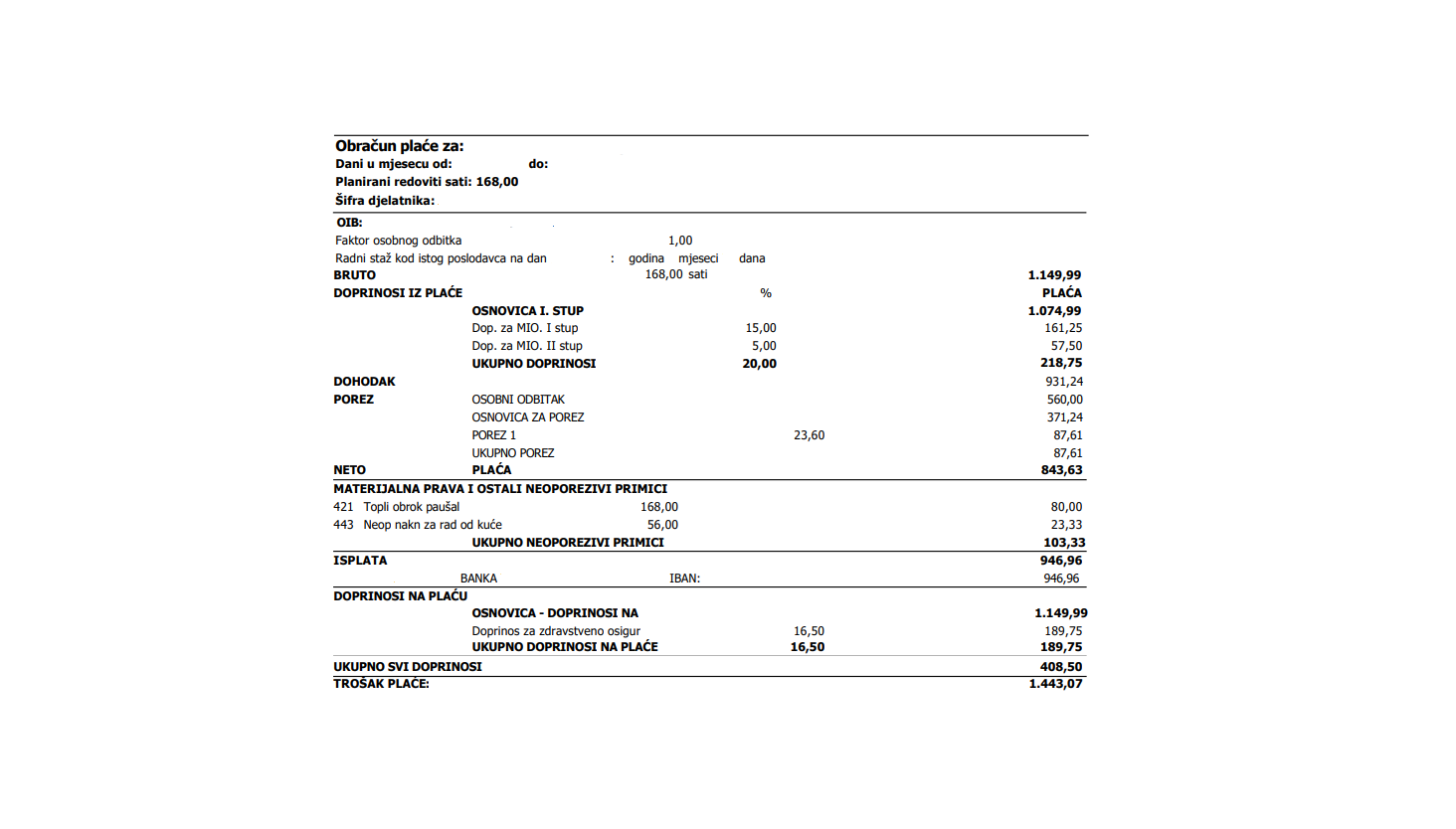

Payroll – example payslip

How to read the payslip? Let’s assume that we want to calculate the salary for an employee in Zagreb who signed an employment contract with his employer in the gross amount of 1,150 euros.

| Item | Amount | Explanation |

|---|---|---|

| GROSS (“BRUTO”) | 1.150 euros | gross or “bruto” salary represents gross1, that is the salary amount negotiated with the employer |

| CONTRIBUTIONS FROM (“DOPRINOSI IZ”) GROSS SALARY | ||

| Basis for pension insurance – Ist pillar (“I stup”) | 1.075 euros | since 2024. the basis for workers with a gross1 salary between 700 and 1.300 euros is decreased according to the formula 0.5x(1.300-gross1) = 75 euros |

| Contribution for pension insurance – Ist pillar (“I stup”) | 161,25 euros | the rate for the first pillar is 15% |

| Contribution for pension insurance – IInd pillar (“II stup”) | 57,5 euros | the rate for the second pillar is 5% |

| TOTAL CONTRIBUTIONS FROM | 218,75 euros | I+II stup = 20% of the pension insurance basis (when the gross1 salary is higher than 1.300 euros, the basis is equal to the gross1 salary) |

| CONTRIBUTIONS TO (“DOPRINOSI NA”) GROSS SALARY | ||

| Health insurance contribution | 189,75 euros | the rate for health insurance contributions is 16,5% |

| TOTAL CONTRIBUTIONS TO | 189,75 euros | |

| TOTAL OF ALL CONTRIBUTIONS | 408,5 euros | contributions from salary + contributions to salary |

| INCOME | 920 euros | gross1 amount (1150 euros) – contributions from the salary (230 euros) |

| TAX | ||

| Basic personal allowance | 560 euros | |

| Tax base | 371,24 euros | income (920 euros) – basic personal allowance (560 euros) |

| Income tax (23,6%) | 87,61 euros | the lower income tax rate in the city of Zagreb has been increased from 20 to 23,6% in 2024 |

| NET (“NETO”) PAY | 843,63 euros | income (920 euros) – income tax (84,96 euros) |

| NON-TAXABLE INCOME | ||

| hot meal reimbursement | 80 euros | |

| travel expenses reimbursement | 47,78 euros | reimbursement of monthly subscription coupon for Zagreb public transport |

| TOTAL NON-TAXABLE INCOME | 127,78 euros | hot meal reimbursement (80 euros) + travel expenses reimbursement (47,78 euros) |

| FOR PAYMENT | 971,41 euros | net salary (835,04 euros) + non-taxable income (127,78 euros) |

| TOTAL SALARY COSTS | 1.339,75 euros | gross salary (1.150 euros) + contributions to salary (189,75 eura) |

Therefore, the salary amount that the employee receives on his account is 971.41 euros, and the salary amount that the employer must spend so that the employee can receive that amount on their bank account is 1,339.75 euros. In other words, the worker must “earn” more than 1,339.75 euros for them to be profitable to the employer.

Salary calculation: fines, executions, and suspensions

In addition to the aforementioned case, the salary calculation or payslip may also contain deductions from wages, such as fines for not performing work or missing hours, deductions for loans, and similar things.

Basis for salary calculation

Some employees in Croatia are confused by the fact that their payslips do not include the basis for salary calculation. The basis for salary calculation, which is usually mentioned in the news, refers to the salary calculation of state officials, civil servants, employees, and other members of public services, and is determined by collective agreements.

The basis for salary calculation is also found in employment contracts in the private sector but is usually not referred to by its full name in the payroll.

Conclusion

The payslip is not incomprehensible, it just seems confusing to employees at first glance. With a little practice, it is possible to go through each item of the payroll easily, and payrolls from different employers should be similar because they must follow the same rules.

The best advice for employees is to conscientiously read the payslip and check each item, because it may happen to the accounting department that, for example, some non-taxable income is not included in the payroll. Knowing how to check your payroll is a valuable skill.